Your cart is currently empty!

Office Space Investment: Unlocking Profits Through Purchase, Renovation, and Strategic Leasing or Resale

Posted Date:

Office Space Investment: Unlocking Profits Through Purchase, Renovation, and Strategic Leasing or Resale

In today’s evolving commercial real estate market, office space remains one of the most compelling investment opportunities—especially for those with the vision to buy, refurbish, and reposition properties for higher returns. Whether you’re looking to rent out an office space on a monthly or yearly basis, or sell it at a premium after strategic improvements, the potential for profit lies in smart acquisition, thoughtful design, and targeted market positioning.

Why Office Space Still Matters

Despite shifts in workplace trends—like hybrid models and remote work—companies still require physical spaces for collaboration, client meetings, and operational functions. Premium, well-designed offices are in demand among growing startups, professional service firms, and multinational companies seeking prestige and functionality.

Furthermore, the right office property can deliver consistent income streams through leasing while offering capital appreciation over time. Investors who understand market needs and trends can transform outdated or underperforming spaces into high-value commercial assets.

The Buy-and-Refurbish Strategy

The buy-and-refurbish model centers on identifying properties that are undervalued due to outdated layouts, worn interiors, or inefficient facilities—and then upgrading them to meet modern business requirements.

Step 1: Identify the Opportunity

Seek properties in strategic locations—close to transport hubs, business districts, or emerging commercial corridors. Look for buildings with solid structural integrity but outdated finishes or poor space planning. These are often priced below market value, providing room for renovation investment without overcapitalizing.

Step 2: Renovate with Purpose

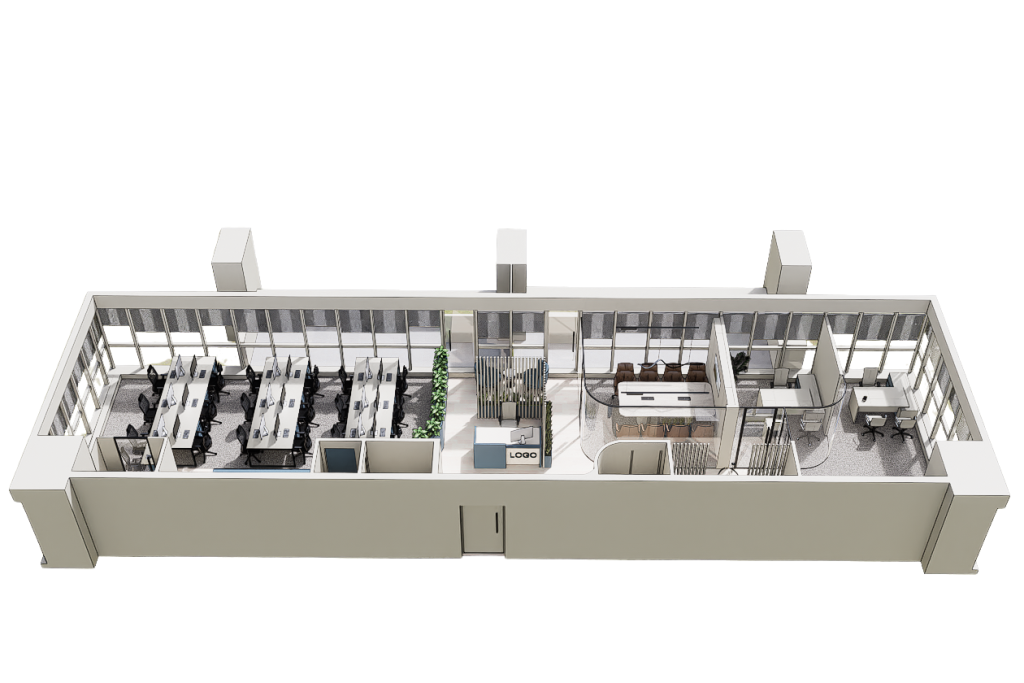

Office tenants today demand more than just desks and meeting rooms. They want open, collaborative areas, wellness-oriented designs, energy-efficient lighting, and seamless technology integration. Upgrading HVAC systems, installing high-speed internet infrastructure, enhancing natural light, and incorporating ergonomic furniture can make a property far more appealing. Aesthetic improvements—such as modern flooring, high-quality finishes, and branded entryways—further enhance perceived value.

Step 3: Maximize Usable Space

Every square meter counts in commercial leasing. Smart interior layouts that optimize work areas, meeting zones, and breakout spaces can increase the property’s leasing potential and rental yield. If zoning and structural allowances permit, consider adding mezzanine floors or reconfiguring walls to accommodate more tenants or flexible workspaces.

Rental Models: Monthly, Yearly, or Hybrid

Once the refurbishment is complete, you have multiple monetization options depending on your cash flow goals, tenant profile, and market conditions.

Monthly Rentals (Short-Term)

Short-term rentals, often in the form of serviced offices or co-working spaces, offer flexibility to tenants and higher per-square-foot rental rates to landlords. This model is ideal in dynamic markets where startups and small businesses prefer minimal commitment. It also allows you to adjust rental rates more frequently in response to demand.

Yearly Rentals (Long-Term)

Long-term leases provide stable, predictable income. Corporations, law firms, and established businesses often commit to multi-year agreements, which reduce tenant turnover and associated marketing costs. While the rental rates per month may be lower than short-term agreements, the security and stability can outweigh the difference.

Hybrid Approach

Some investors combine both models by dedicating part of the building to long-term tenants and allocating a portion to short-term leases or shared spaces. This strategy diversifies risk and optimizes occupancy.

The Sell-for-Profit Model

In certain markets, the fastest route to return on investment is to sell after refurbishment. Once you’ve upgraded and repositioned the property, its value can increase significantly—especially if you’ve secured reputable tenants on favorable leases. Institutional buyers, REITs, and high-net-worth individuals often pay premiums for turnkey, income-producing assets.

For example, purchasing an outdated office for AED 5 million, investing AED 1 million in renovations, and securing a five-year lease with a well-known tenant could push the property’s market value to AED 8 million or more—yielding a substantial profit.

Key Considerations for Success

1. Market Research

Understanding your target market is critical. Analyze local rental rates, vacancy levels, tenant demand, and competing properties. Identify what amenities or features can give your office space an edge.

2. Budget Discipline

Set a renovation budget with clear ROI projections. Avoid over-customizing the space for a niche tenant unless you have a pre-signed agreement. Focus on improvements that universally enhance value.

3. Compliance and Permits

Commercial refurbishments often require building permits, fire safety approvals, and adherence to accessibility regulations. Partnering with experienced architects and contractors ensures compliance from day one.

4. Professional Design and Branding

An office space is more than walls and workstations—it’s a brand statement for tenants. Collaborating with an experienced architecture and interior design studio can create a cohesive, market-ready environment that justifies premium rents or sales prices.

5. Marketing Strategy

Highlight your property’s unique selling points through high-quality photography, 3D virtual tours, and targeted campaigns. Engage commercial real estate brokers who have access to your ideal tenant or buyer demographic.

Case Study Example

Consider a mid-sized investor who acquires a 500-square-meter office floor in a prime Dubai location for AED 4 million. The property’s interior is dated, with heavy partitioning and inefficient lighting. By investing AED 500,000 in renovations—introducing an open layout, glass partitions, modern lighting, upgraded restrooms, and a branded reception—the investor transforms the space into a high-demand commercial hub.

The result:

- Rental Option: Leasing the renovated space at AED 1,200 per square meter annually generates AED 600,000 in yearly income, representing a 12% gross yield.

- Sale Option: Selling the property post-renovation could fetch AED 5.5 million to AED 6 million, depending on the strength of tenant agreements—yielding a 25–30% return on total investment within 12 months.

The Role of Design in Maximizing Returns

Design is the bridge between raw potential and marketable reality. A well-planned refurbishment not only improves functionality but also enhances perceived prestige—an essential factor in commercial leasing and sales.

This is where professional studios like Axis Studio Dubai excel. With expertise in commercial architecture, interior design, and investment-driven property enhancement, we specialize in transforming underperforming spaces into high-value assets. Our holistic approach ensures that every design decision—from spatial planning to material selection—aligns with your financial goals, whether that’s maximizing rental yield or achieving a premium sale price.

Investing in office space with a buy-and-refurbish strategy is a proven path to building wealth in commercial real estate. The combination of strategic acquisition, targeted renovations, and smart monetization models can deliver both steady income and substantial capital gains.

In markets like Dubai—where demand for premium office environments continues to grow—this approach offers an exciting blend of stability and upside potential. Whether your goal is to rent monthly, lease long-term, or sell at a higher price, the key lies in understanding the market, executing renovations with precision, and positioning the property to meet the evolving needs of today’s businesses.

When done right, an office space investment isn’t just about property—it’s about creating a dynamic, revenue-generating asset that works for you for years to come. For tailored investment strategies and world-class interior design services to maximize your office property’s value, contact www.axisstudiodubai.com today.

Leave a Reply